Top 3 Docs Quick Launch

Create New Company Create New Family Trust Create New SMSFNew Release

Trust Distribution Minutes Library for 2024/25 - Multi-Use View Full RangeJoin

it's free

Need legal advice or a specially customised legal document?

Contact our partner law practice

Click here to arrange a quote

| Print Version | Back |

SMSFs - Back to basics

Issue: 441 - Thursday, 22 August 2013

In this Issue

- SMSFs - Back to basics

1. SMSFs - Back to basics

Introducing - Monica Rule. Monica joins Law Central as a Bulletin contributor after having worked for the Australian Taxation Office (ATO) from 1985 to 2013. During the past 17 years, she has worked as a technical advisor and trainer, as well as a senior compliance officer in the Superannuation Business Line of the ATO. As you know the ATO is the Regulator of Self Managed Superannuation Funds (SMSFs) and Monica has drawn upon her experience to publish a book – The Self Managed Super Handbook – and contribute columns to both the Australian and West Australian newspapers. During her time at the ATO, Monica has developed training packages for staff, presented external seminars for professionals, accompanied senior management on external presentations as a technical expert, and most importantly liaised with SMSF trustees, accountants, auditors and lawyers when auditing SMSFs. Monica received four awards for technical excellence for her work in superannuation and compliance. We are pleased to have Monica on our team of SMSF experts.

It is without a doubt that the number of SMSFs have grown at a phenomenal rate over the past few years. According to statistics issued by the ATO, there are approximately 480,000 SMSFs with over 900,000 members in Australia. In Monica’s first Law Central Bulletin, we start with the potential structures of an SMSF.

Establishing a Self Managed Superannuation Fund

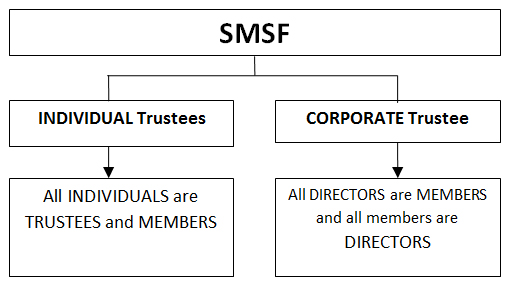

You can establish an SMSF under either an individual trustees’ structure or a corporate trustee structure. The chart below illustrates these structures.

To establish an SMSF under individual trustees structure with more than one member, you must meet all of the following conditions required under subsection 17A(1) of the Superannuation Industry (Supervision) Act 1993 (SISA). The conditions are:

- your SMSF must not have more than four members;

- all members must be trustees of the SMSF and all trustees must be members;

- the individual trustees must not receive any payment from the SMSF for performing their duties as trustees of the SMSF; and

- you cannot have any person in your SMSF who is an employee unless the person is a relative (however, there are exceptions to this last requirement which will be explained further).

To establish an SMSF under individual trustees structure with more than one member, you must meet all of the following conditions required under subsection 17A(1) of the Superannuation Industry (Supervision) Act 1993 (SISA). The conditions are:

- your SMSF must not have more than four members;

- all members must be trustees of the SMSF and all trustees must be members;

- the individual trustees must not receive any payment from the SMSF for performing their duties as trustees of the SMSF; and

- you cannot have any person in your SMSF who is an employee unless the person is a relative (however, there are exceptions to this last requirement which will be explained further).

To establish an SMSF under a corporate trustee structure with more than one member, the conditions that must be met are:

- your SMSF must not have more than four members;

- each director of the company must be a member of the SMSF and each member of the SMSF must be a director of the company that is acting as the corporate trustee;

- the directors of the corporate trustee must not receive any payment for the performance of their services as directors in relation to the SMSF; and

- you cannot have any person in your SMSF who is an employee unless the person is a relative (I’ll explain this in more detail later).

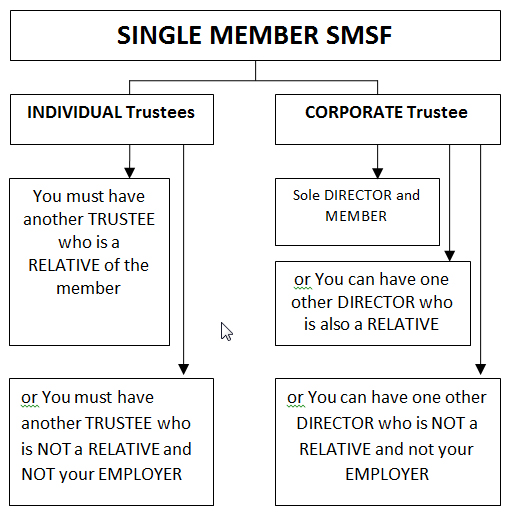

For SMSFs with only one member, you will need to meet the following conditions:

If the SMSF is set up with individual trustees, then you must have two trustees where:

- the single member is one of only two trustees, where one is the member and the other is a relative of the member; or

- the single member is one of only two trustees, and the member is not an employee of the other trustee; and

- the two individual trustees do not receive any payment from the SMSF for performing their duties as trustees.

The reason you must have two trustees for a single member fund under an individual trustee structure is because under the general trust law, you cannot be the sole trustee and sole beneficiary. You are effectively considered to be “wearing both hats at the same time” which creates a conflict of interest.

If the single member SMSF is set up with a corporate trustee, then:

- the single member must be the sole director of the company acting as the corporate trustee; or

- the single member must be one of two directors of the company, and the member and the other director are relatives; or

- the single member must be one of only two directors of the company, and the member is not an employee of the other director; and

- the director(s) does/do not receive any payment for the performance of their services as directors in relation to the SMSF.

The chart below illustrates the requirements quite clearly:

Earlier I mentioned that you cannot have any person who is working with you as an employee in your SMSF unless that person is a relative of yours. This is because when the SISA was first written, the definition of an “employee” under subsection 17A(6) of the SISA states that if your SMSF is to receive employer superannuation contributions for your employees then the following people will also be considered your employees:

- any relative of the individual employer;

- any director of the employer company and any relative of those directors;

- any beneficiary of the employer trust and any relative of those beneficiaries;

- any partner of the employer partnership and any relative of those partners;

- any director (and his or her relatives) of a company that is a partner in the employer partnership;

- any beneficiary (and his or her relative) of a trust that is a partner in the employer partnership.

The reason for this rather inclusive definition of an employee is because when the Government first introduced SMSFs, it only wanted people who were related to each other to be in an SMSF together. However, this caused some problems for small businesses that wanted to set up SMSFs with members who were working together but were not related to each other. The SISA was changed to deem certain people as not being an employee so that they could establish an SMSF together.

Gold and Platinum Members read on to see who is deemed not to be an “employee”.

Common errors

Some of the most common errors that I have come across while auditing SMSFs are:

- an SMSF established with both individual trustees and a corporate trustee

- not all directors of the company are members of the SMSF

- not all members of the SMSF are directors of the company acting as a corporate trustee

- more than four members in the SMSF

- single member funds with one individual trustee

- single member funds with a corporate trustee with three directors

It’s important to establish a structure that not only suits your needs but also complies with the law. Getting it wrong can prove to be a costly exercise if the ATO asks you to rectify something or worse still – start over.

Build these documents now:

- Self Managed Superannuation Fund Deed

- Investment Strategy for Self Managed Super

- Build a Company (ELodgement)

- SMSF – Deed Update

To understand how the superannuation law applies to SMSFs, read my book The Self Managed Super Handbook: Superannuation Law for Self Managed Superannuation Funds in plain English (available soon from Law Central) .

Australia

Australia  New Zealand

New Zealand